Often, when talking about taxes in Mexico, people associate them with the Tax Administration Service and federal authorities, without realizing that states are also empowered to impose taxes (on this topic, see Contributions Contemplated in Mexico). And how could this not be the case, given that the majority of the taxes that hit taxpayers hardest are federal taxes?

That’s why, in order to educate taxpayers about the main taxes in our state of Chihuahua and how its tax law works, I decided to begin a series on «local tax law» in the entry Tax Regulations in Chihuahua, Mexico. However, this series would be incomplete if I didn’t address the main taxes our state collects to cover its public spending.

In that sense, if in the minds of ordinary Chihuahuans, they are only aware—and sometimes—of the Income Tax Law and the Value Added Tax Law, as these are the taxes they bear the most in their daily lives, It’s also true that state and municipal taxes can make the difference between starting a business or not. These taxes, as I said, are rarely known.

Given this, for the purpose of this post, I will discuss each one of the taxes in force for the state of Chihuahua. As the reader will see, these taxes are so few that they are easily grouped into a single law. This is done to provide Chihuahuans and foreigners with knowledge that will ultimately enable them to assert their rights as taxpayers.

List of Contents

- 1) Regulations and Taxes

- 2) Common Provisions For Taxes On Gambling, Raffles, and Contests

- 3) Tax On Income Received By the Organization of Gambling and Raffles

- A) Purpose

- B) Subjects

- C) Rate and Base

- D) Deductions

- E) Accrual and Time of Payment

- F) Exemptions

- 4) Tax On Prizes Obtained From Lotteries, Raffles, Drawings, Gambling, and/or Contests of All Kinds

- A) Purpose

- B) Subjects

- C) Tax Basis

- D) Rates

- E) Accrual and Payment Period

- F) Obligations of Withholding Agents

- 5) Tax On Expenses Incurred in Gambling Games

- A) Subject and Purpose

- B) Basis

- C) Rate

- D) Accrual and Time of Payment

- E) Joint Liability

- 6) Fixed-Income Tax On Rental Income and On Granting the Temporary Use or Enjoyment of Real Estate

- A) Subjects

- B) Basis

- C) Rate and Payment Period

- D) Authorized Deductions

- E) Fixed Deduction

- G) Deduction for Partial Occupation of the Property by the Taxpayer

- H) Opportunity to Take Deductions

- I) Other Obligations

- 7) Income Tax on Income From the Disposal of Real Estate

- A) Subjects and Purpose

- B) What Should Be Considered as Income?

- C) Base, Rate, and Payment Period

- D) Withholding and Payment by Public Notaries

- E) Valuation of Real Estate

1) Regulations and Taxes

The local taxes established for the state of Chihuahua are as follows:

I.- Tax on expenditures incurred in gambling.

II.- Tax on income received from the organization of gambling and raffles.

III.- Tax on winnings in lotteries, raffles, drawings, gambling, and/or contests of all kinds.

IV.- Tax on leasing and granting the temporary use or enjoyment of real estate.

V.- Tax on income derived from the sale of real estate.

VI.- Lodging tax.

VII.- Tax on the acquisition of motor vehicles and other used personal property.

VIII.- Tax on overdue surpluses.

IX.- Tax on the final sale of alcoholic beverages.

X.- Tax on payroll and similar items.

XI.- Additional university tax.

XII.- Contribution to the Red Cross.

Taxes that are contemplated, along with other types of contributions, in the Chihuahua State Finance Law, which will serve as a guide for this entry.

2) Common Provisions For Taxes On Gambling, Raffles, and Contests

In order to understand the taxes levied on gambling, raffles, and contests, gambling shall be understood as:

I.- Those in which the prize can be obtained through the skill of the participant, or by mere chance, in the use of machines.

II.- Those in which electronic visual images such as numbers, cards, symbols, figures, or similar are used in their development, regardless of whether chance intervenes directly or indirectly at any stage of their development.

III.- Those in which the participant must be present during the game, either actively or as a spectator.

IV.- Games in which the participant uses machines that utilize algorithms developed in electronic systems or any other mechanical, electronic, or electromagnetic means in which the outcome does not depend on factors that are controllable or susceptible to being known or controlled by the participant.

V.- Remote betting, also known as foreign betting books, authorized by the competent authority to collect and operate betting matches on events, sporting competitions, and games permitted by law, held abroad or in the country, broadcast in real time and simultaneously via video, audio, or both.

VI.- Those authorized by the competent authority, in which bets are received, collected, crossed, or exploited.

Regarding the concept of bets, this should be understood as the amounts in cash, in kind, or delivered by any other means that are risked in a game, with the possibility of obtaining or winning a prize.

3) Tax On Income Received By the Organization of Gambling and Raffles

A) Purpose

The purpose of this tax is the income received by the organization of gambling and/or raffles, regardless of their name, held within the state of Chihuahua.

B) Subjects

Individuals and legal entities that organize gambling and/or raffles are subject to this tax. Those who administer, operate, or prepare gambling and raffles are included as subjects of this tax when organizing gambling and/or raffles.

C) Rate and Base

The tax will be calculated by applying a rate of 6% of the total value of the income received by the organization of gambling and/or raffles.

The value will be considered the total amounts actually received from participating in gambling and/or raffles, whether paid in cash, in kind, or by any other means. In games or raffles in which bets are placed, the value will be considered the total amount of the bets.

On the other hand, when payment is made in kind or by any other means, the value will be considered the total of the equivalent amounts in national currency, taking into account the invoice or award value, the commercial appraisal value, or, where applicable, the value covered by said means.

When a raffle prize is contained in a referenced and hidden manner in goods whose acquisition grants the right to participate in the raffle, the value will be considered the price at which the person conducting the raffle has sold all the goods participating in that tournament.

In the case of raffles in which participants obtain such status, even free of charge, by acquiring a good or contracting a service, receiving a receipt for such purpose, the value will be considered the total nominal amount for which each receipt granting the right to participate is delivered, in accordance with the conditions of the raffle established in the permit granted by the competent authority.

D) Deductions

Persons who obtain income from this tax may make the following deductions:

I.- The value of prizes paid or awarded.

In the case of prizes other than cash, the value stipulated in the permit granted may be deducted, or failing that, the invoice value or the commercial appraisal value.

II.- Amounts returned to participants before the games or drawings are held.

The deductions indicated in the preceding paragraphs shall not include contributions withheld or transferred from local or federal taxes. Furthermore, in order for the amounts referred to in these deductions to be deductible, they must be recorded in the accounting system, in the central betting system, or an equivalent system.

E) Accrual and Time of Payment

The tax shall be calculated monthly and shall be paid no later than the 15th of the month following the month to which the income is derived. Payments shall be made through a declaration submitted on officially approved forms. Such payment shall be deemed final.

F) Exemptions

The tax referred to in this section shall not be payable when gambling and/or raffles are organized by exempt taxpayers, meaning those referred to in the Tax Code of the State of Chihuahua[1].

4) Tax On Prizes Obtained From Lotteries, Raffles, Drawings, Gambling, and/or Contests of All Kinds

A) Purpose

This tax applies to income received from winning prizes derived from participation in lotteries, raffles, drawings, gambling, and contests of all kinds, regardless of the location of the event.

However, for the purposes of this tax, the refund corresponding to the ticket that allowed participation in lotteries will not be considered a prize.

B) Subjects

This tax applies to individuals or legal entities that purchase or acquire tickets, passwords, or any other receipt that allows participation in the respective events and that win a prize within the state of Chihuahua, regardless of where the event is held.

In any case, the individuals or institutions that organize or hold the corresponding events are required to withhold the tax.

For the purposes of this tax, individuals or legal entities that obtain a prize or any other benefit, regardless of its name, derived from a lottery, raffle, drawing, gambling, and/or contest of any kind will also be considered subjects.

C) Tax Basis

The tax basis is the total determined or determinable value of the prize obtained. In the case of prizes in kind, the tax basis will be the value at which each prize is advertised; failing that, the invoice value; and, in the absence of both, the commercial appraisal.

Finally, the Additional University Tax will not apply to this tax.

D) Rates

The tax amount will be calculated by applying a 6% rate to the taxable base. Similarly, the 6% rate will also be applied to the tax derived from gambling.

E) Accrual and Payment Period

The tax will be accrued at the time the respective prize is paid, regardless of the location where the event is held.

On the other hand, withholding agents will make payment of the tax no later than the 15th of the month following the month to which the payment corresponds, submitting the approved declaration to the corresponding collection office. Said payment will be deemed final.

F) Obligations of Withholding Agents

Withholding agents for this tax will have the following obligations:

I.- Request registration in the State Registry of Taxpayers, using the forms approved for such purposes. For this purpose, legal entities will be required to provide a copy of the respective certificate or document.

II.- Submit the required notices and declarations to the corresponding Revenue Collection Office within the established deadlines.

III.- Withhold and pay the tax accrued related to this tax.

IV.- Keep at the disposal of the tax authorities and present upon request the supporting documentation of the events held and the payment of the tax.

V.- To pay an amount equivalent to the amount they should have withheld, even if they did not make the withholding.

Finally, the Federal Government, the Government of Mexico City, the state governments, the municipalities, the National Savings Trust, the National Lottery and Sports Predictions for Public Assistance, and political parties, as well as private assistance institutions, educational institutions, and social charities, will withhold and pay the tax incurred for prizes awarded to those who purchase or acquire tickets, passwords, or any other receipt that allows them to participate in the corresponding events within the state of Chihuahua.

5) Tax On Expenses Incurred in Gambling Games

A) Subject and Purpose

Individuals and legal entities that incur expenses to participate in gambling games held or organized within the state of Chihuahua are subject to this tax.

B) Basis

Expenses to participate in gambling games shall be considered to include amounts paid for access to and use of machines or facilities related to gambling games, regardless of their name, as well as additional charges and recharges made using cards, magnetic strips, electronic devices, tokens, passwords, receipts, or any other means that allow participation in gambling games, whether such expenses are used on the date the payment is made or on a later date.

C) Rate

The tax will be calculated by applying a 10% rate to the total amount of expenditures made to participate in gambling games, whether in cash, in kind, or by any other means.

When payment is made in kind or by any other means, the value will be considered the total of the equivalent amounts in national currency, taking into account the invoice or award value, the commercial appraisal, or, where applicable, the value covered by said means.

D) Accrual and Time of Payment

The tax will be accrued when the obligated party pays the amounts or consideration that allow them to participate in gambling games.

On the other hand, the operator of the establishment where gambling games are held must withhold the tax upon receiving the corresponding payment or consideration, and must pay it to the authorized offices no later than the 15th of the month following the month to which the withholding applies.

Operators of establishments where gambling is carried out are required to issue receipts for the withholdings made, which expressly and separately state the amount withheld.

E) Joint Liability

The following individuals or legal entities shall be responsible for paying this tax:

I.- Those who organize, manage, operate, or sponsor gambling.

II.- Those who receive amounts to allow third parties to participate in the games subject to this tax.

III.- The owners or legitimate holders of gambling machines.

6) Fixed-Income Tax On Rental Income and On Granting the Temporary Use or Enjoyment of Real Estate

A) Subjects

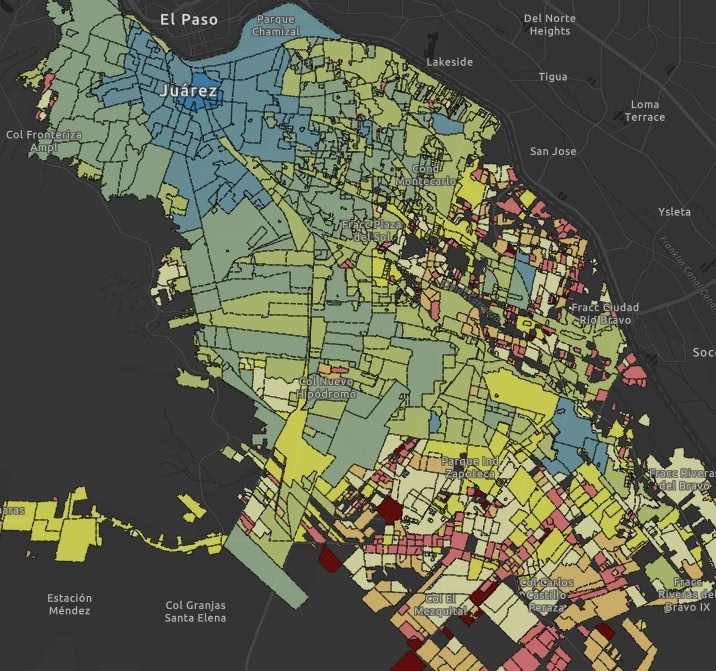

Individuals who receive income from granting the temporary use or enjoyment of real estate located within the state of Chihuahua are required to pay this tax, regardless of the state in which the taxpayer has their tax domicile.

On the other hand, this type of tax, which is deeply rooted in various states, has sparked a debate about whether it violates the principle of tax equity (which can be studied in my post Constitutional Principles of Taxes in Mexico) and results in unfair double taxation.

B) Basis

The following are considered income from granting the temporary use or enjoyment of real estate:

I.- Income from leasing or subleasing and, in general, from granting the temporary use or enjoyment of real estate for valuable consideration in any other manner.

II.- Income from non-amortizable real estate participation certificates.

On the other hand, for the purposes of this tax, income received in cash, goods, services, and credit will also be considered income. The latter will be declared, and the corresponding tax will be calculated up to the calendar month in which they are collected.

Regarding trust income, in trust transactions granting the temporary use or enjoyment of real estate, the increases will be considered income of the settlor even if the trustee is a different person, except for irrevocable trusts in which the settlor does not have the right to reacquire the real estate from the trustee, in which case the income will be considered income of the trustee from the moment the settlor loses the right to reacquire the real estate.

In any case, the trust institution will make payments of this tax on behalf of the person to whom the income corresponds, in accordance with the terms of the previous paragraph, through a monthly declaration as set forth in the following section.

C) Rate and Payment Period

Taxpayers with income eligible for this tax will make quarterly payments at a rate of 5%, which will be applied to income from leasing and, in general, from granting the temporary use or enjoyment of real estate, reducing the authorized deductions.

The declaration and payment of this tax will be made in accordance with the terms established by the Tax Code of the State of Chihuahua, with the deadline being the 15th of the month immediately following the month to which the payment is due.

For the purposes of this tax, the calendar year will be divided into four periods as follows: the first for January, February, and March; the second for April, May, and June; the third for July, August, and September; and the fourth for October, November, and December.

D) Authorized Deductions

Persons who earn income from the items referred to in this tax may make the following deductions:

I.- Property tax payments for the calendar year on said properties, as well as special contributions levied thereon.

II.- Maintenance expenses that do not involve additions or improvements to the property in question, and water consumption expenses, provided they are not paid by those who use or enjoy the property.

III.- Actual interest actually paid on loans used for the purchase, construction, or improvements to real estate.

For these purposes, actual interest shall be considered the amount by which the interest exceeds the adjustment for inflation. The inflation adjustment will be determined by multiplying the average daily balance of the loan or financing that generates interest by the factor obtained by subtracting the unit from the quotient resulting from dividing the National Consumer Price Index for the most recent month of the investment period by the aforementioned index corresponding to the first month of the period.

When the calculation referred to in the preceding paragraph is performed for a period of less than one month or covers fractions of a month, the percentage increase in the aforementioned index for said period or fraction of a month will be considered in proportion to the number of days for which the calculation is performed.

Likewise, the average daily balance of the loan or financing that generates interest will be the balance obtained by dividing the sum of the daily balances of the loan or financing that generates interest.

IV.- Salaries, commissions, fees, as well as any taxes, fees, or contributions that, according to law, they are required to pay on said salaries actually paid and that are related to the activities that generate the income taxed by the Cedular Tax.

V.- The amount of insurance premiums covering real estate.

VI.- Investments in construction, including additions and improvements, under the terms established by the Income Tax Law and its regulations for individuals who grant temporary use or enjoyment of real estate.

E) Fixed Deduction

Taxpayers may choose to deduct 35% of the income covered by this tax, in lieu of the authorized deductions. Those who exercise this option may also deduct the amount of the Property Tax disbursements for said properties corresponding to the calendar year, or the period during which they obtained the income in the calendar year, as applicable.

Taxpayers who choose to apply this fixed deduction must do so for all properties for which they grant temporary use or enjoyment, including those in which they are co-owners, no later than the date on which the first tax return corresponding to the calendar year in question is filed. Once exercised, the deduction cannot be changed in the payments for that year. The option can be changed when filing the first tax return of the following year.

F) Deductions for Subletting

In the case of subletting, only the amount of rent paid by the tenant to the landlord will be deductible.

G) Deduction for Partial Occupation of the Property by the Taxpayer

When the taxpayer occupies part of the property from which income is derived by granting its temporary use or enjoyment, or granting its temporary use or enjoyment free of charge, they may not deduct the portion of the expenses, nor the Property Tax and special improvement contributions that correspond proportionally to the unit they occupy or the one granted free of charge. In the case of sublease, the subleaser may not deduct the proportional portion of the rent paid corresponding to the unit they occupy or grant free of charge.

H) Opportunity to Take Deductions

When making the payments referred to in this tax, taxpayers shall make the deductions corresponding to the period for which the return is filed. When the deductions are not made within the period to which they correspond, they may be made in subsequent periods of the same calendar year. In the case of investments, taxpayers subject to this tax may deduct one-fourth of the deduction corresponding to the calendar year from their income for the period, regardless of the use of the property in question.

If the income received is less than the deductions for the period, taxpayers may consider the resulting difference between the two concepts as deductible in subsequent periods, provided that said deductions correspond to the same calendar year.

I) Other Obligations

Taxpayers subject to this tax, in addition to making tax payments, must have the following obligations:

I.- Request registration with the State Taxpayer Registry.

II.- Maintain accounting records when they obtain income exceeding 50,000 pesos (FIFTY THOUSAND 00/100 NATIONAL CURRENCY) from the provisions of this tax in the previous calendar year.

Those who opt for the aforementioned fixed 35% deduction are not covered by the provisions of this section.

III.- Issue receipts for the compensation received.

IV.- File returns in accordance with the terms established by law.

Finally, it is important to note that when the income subject to this tax is received through trust transactions, the trustee institution will maintain the books, issue receipts, and make payments for this tax.

7) Income Tax on Income From the Disposal of Real Estate

A) Subjects and Purpose

This tax shall be paid by individuals who receive income from the disposal of real estate located within the state of Chihuahua.

For the purposes of this tax and to better understand its purpose, income from the disposal of real estate shall be considered as income derived from:

I.- Any transfer of ownership, even if the transferor retains ownership of the transferred property.

II.- Awarding of assets, even if made to the creditor.

III.- Contributions to a company or association.

IV.- Contributions made through a trust, in the following cases: a) in the act in which the settlor designates or undertakes to designate a trustee other than himself, and provided that he does not have the right to reacquire the assets from the trustee; b) in the event that the settlor loses the right to reacquire the assets from the trustee, if such right has been reserved.

V.- The transfer of rights held over the assets subject to the trust, at any of the following times: a) in the event that the designated trustee assigns his or her rights or instructs the trustee to transfer ownership of the assets to a third party. In these cases, the trustee shall be deemed to have acquired the assets upon his or her appointment and to have disposed of them upon assigning his or her rights or giving such instructions; b) in the event that the settlor assigns his or her rights, if these include the right to have the assets transferred to him or her.

VI.- The transfer of ownership of a tangible asset or the right to acquire it, effected through the alienation of negotiable instruments or the assignment of rights representing them. The provisions herein do not apply to shares or corporate interests.

Finally, in the case of an exchange, two transfers will be considered.

B) What Should Be Considered as Income?

The amount of consideration obtained in cash, goods, services, or credit, as a result of the transfer, will be considered income. However, when, due to the nature of the transfer, there is no consideration, the appraisal value will be used, subject to prior authorization from the tax authorities.

Finally, income from the transfer of ownership of real estate due to death or donation will not be considered income from transfer.

C) Base, Rate, and Payment Period

To determine the taxable base of this tax and its exemptions, the legislator makes express reference to the General Provisions and Chapter IV, Title IV of the Income Tax Law and its regulatory provisions.

On the other hand, taxpayers who obtain income from the sale of real estate must pay the tax for each transaction they carry out, applying the 5% rate to the taxable amount determined in accordance with the previous paragraph. This payment must be made through a declaration to be filed within 15 days of the date of sale, in accordance with the provisions of the Tax Code of the State of Chihuahua.

D) Withholding and Payment by Public Notaries

In the case of transactions recorded in a public deed, the notaries, under their responsibility, must calculate and withhold the tax referred to in this tax and pay it within 15 days of the date the deed or memorandum is signed, in accordance with the terms established in the Tax Code of the State of Chihuahua.

However, notaries are exempt from the obligation to calculate and pay this tax when the sale of real estate is carried out by individuals engaged in business activities. The provisions of the Income Tax Law and its regulations must be observed.

E) Valuation of Real Estate

Taxpayers may request an appraisal by a certified public broker or a credit institution specializing in appraisal, duly accredited by the State Department of Professions. The Treasury Department of the State of Chihuahua will be empowered to perform, order, or consider the appraisal of the property being sold.

By Omar Gómez

Mexican Tax, Administrative, and Constitutional Attorney

Contact me at hola@ogomezabogado.com

[1] See Article 1 of said code, which stipulates:

Article 1.- In the State of Chihuahua, individuals and legal entities are obligated to contribute to public expenses in accordance with the respective tax laws. The provisions of this Code shall apply in the absence of the aforementioned laws.

Notwithstanding the foregoing, the following are exempt from paying taxes:

a) Public and private charitable institutions and associations.

b) Cooperative societies, in accordance with the tax provisions of the State.

c) Other persons expressly indicated in the tax provisions of the State. […].